As the world shifts gears toward electric mobility and clean energy, batteries are acting as the new oil, and nations are in a rush to secure supremacy in the strategic field. India is also coming of age to join the big league with plans to emerge as a top producer of sophisticated automotive battery cell. But the question arises here: can this country, which even now imports a majority of its cells today, become a global battery hub? In this article we will explore how India is gaining momentum, technological advancements, and tackling challenges while trying to make in India and power the world.

The Global Battery Market and where India positions itself

With the rapid adoption of electric vehicles (EVs) and energy storage needs, the global demand for lithium-ion batteries is forecast to exceed 5,500 GWh by 2030. Currently, the global leader of this landscape is China, as it has more than 75% of global cell manufacturing capacity, followed by South Korea and Japan. In contrast, India holds less than 2% of the global capacity. However, with the launch of the Production-Linked Incentive (PLI) Scheme for Advanced Chemistry Cell (ACC) manufacturing, India aims to add 50 GWh of capacity, signaling a serious commitment to scaling up.

Government Push: Policies Driving the Boom

The government of India has made serious efforts to spur indigenous battery manufacturing:

- PLI Scheme for ACC: With an expenditure of INR 18,100 crore, this scheme prefers the establishment of 50 GWh of local ACC production capacity. Sanctioned bidders are Rajesh Exports, Ola Electric, and Reliance New Energy.

- FAME II (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles): This scheme provides incentives to consumers and manufacturers, indirectly encouraging the demand for batteries.

- Custom Duty Waivers and R&D Grants: Tax incentives on battery components and government-funded R&D support local innovation.

- Budget 2024-25: Repackages support to grid-scale energy storage and EV ecosystem.

Big Players, Bigger Ambitions: Who’s Building What?

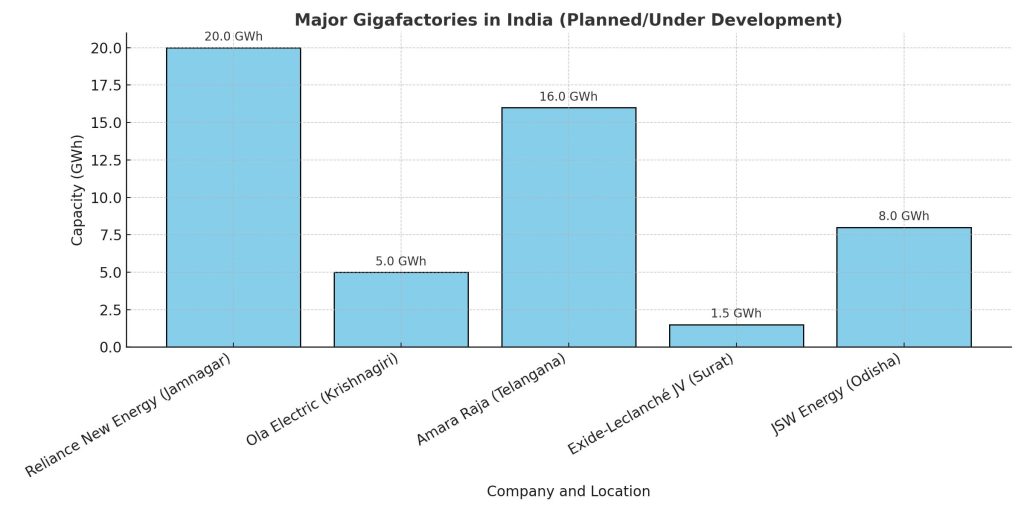

India’s private sector is responding vigorously to policy push:

- Reliance New Energy is constructing a 20 GWh gigafactory in Jamnagar, Gujarat, using Faradion’s sodium-ion technology.

- Ola Electric is constructing a 5 GWh unit in Krishnagiri, Tamil Nadu, with a target of 100 GWh by 2030.

- Amara Raja Energy & Mobility is investing in a 16 GWh unit in Telangana’s ‘Battery Valley’.

- Exide Industries and Leclanché JV (Nexcharge) have established a lithium-ion battery pack plant near Surat.

- JSW Energy has announced a gigafactory in Odisha.

These developments signify a paradigm shift from battery pack assembly to full cell manufacturing in India.

India’s Special Advantage (and Bottlenecks)

India has a number of advantages over its competitors:

- Cost-effectiveness: Competitive pricing for batteries can be achieved through reduced labor expenses and policy support.

- Strategic Location: Perfect for exporting to Africa, the Middle East, and Southeast Asia.

- Domestic Market: There is a significant internal demand due to the sizeable and expanding EV market.

However, significant bottlenecks still exist:

- Dependency on Raw Materials: More than 70% of cobalt and lithium are imported.

- Limited Upstream Supply Chain: Cathodes, anodes, and electrolytes are not produced domestically in India.

- Technology Gap: There is little domestic IP, and the majority of cell chemistries are imported or licensed.

- Infrastructure Gaps: Scalability is hampered by logistics limitations and power availability.

Tech Focus: India’s Advanced Chemistry Cells

The energy density, lifecycle, and range of applications of Advanced Chemistry Cells (ACC) are different from those of conventional lithium-ion cells. India is concentrating on:

- EVs can use LFP (lithium iron phosphate) chemistries and NMC (nickel manganese cobalt) chemistries.

- Sodium-ion and solid-state batteries for next-generation uses.

- A drive towards domestic innovation is demonstrated by Tata Chemicals’ R&D in cathode materials and Reliance’s entry into the sodium-ion market.

- Novel electrolytes and thermal management systems are being actively researched by CSIR and IITs.

Is India Able to Face Off Against Europe, China, and Korea?

India is making progress, but there is intense competition:

- With its integrated supply chains and ultra-large-scale manufacturing, China’s CATL dominates the global market.

- Leading manufacturers of high-performance cells are Samsung SDI and LG Energy Solution.

- Northvolt in Europe is pushing the clean battery production forward.

- The potential of India is to become a “China +1” destination — providing geopolitical diversification for global players. The technology gap will be bridged by public-private partnerships and joint ventures.

Global Lithium-Ion Battery Manufacturing Capacity by Country (2023)

| China | ~1,800 | ~70% |

| Europe | ~400 | ~15% |

| United States | ~200 | ~8% |

| South Korea | ~100 | ~4% |

| Japan | ~60 | ~2% |

| Others | ~40 | ~1% |

| Total | ~2,600 | 100% |

Note: These figures are approximate and based on available data as of 2023. IEA

Energizing the World or Serving the Country?

India plans to manufacture more than 100 GWh of battery cells per year by 2030. Part of this, if done well, can be export-oriented. But the immediate focus is going to be on meeting local EV and energy storage needs. Further, efforts on battery recycling, second-life use, and mineral refining will make India a global value chain player. Attero Recycling is already gaining traction in lithium-ion battery recycling.

Batteries, Bharat, and the Big Bet

India’s leap into advanced automotive cell manufacturing is more than just an industrial ambition—it’s a strategic pivot in the global clean energy race. With the proper combination of policy, private investment, and innovation, India has the potential to grow from a battery consumer to a battery powerhouse. It will power the world or charge the world’s mobility future first; the momentum is true, and the world is watching.