What if the future of electric vehicles had nothing to do with pricey imported lithium and instead was as simple and as plentiful as table salt? With sodium-ion battery technology gaining traction globally, and especially in China, the nagging question arises—can India build its own “heart” of a sodium-based ecosystem that then ramps up Indian self-reliance and reduces costs? Given that India’s EV market is maturing, along with straining lithium supply chains, this is the right time to carefully consider whether sodium-ion batteries could be India’s next transition in its energy transition.

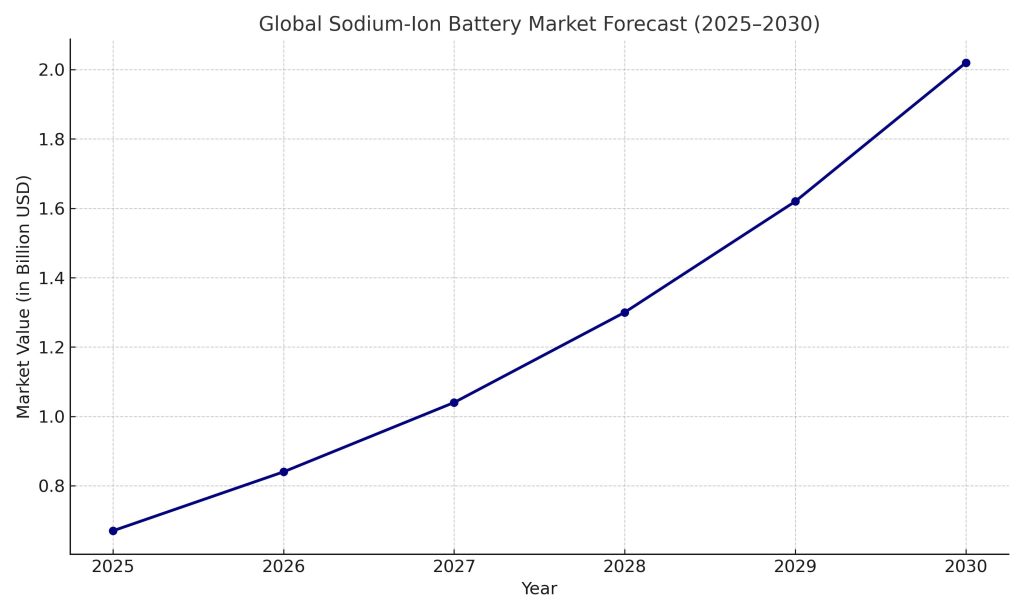

According to Markets and Markets the global sodium-ion battery market is estimated to grow from US $0.67 billion in 2025 to US $2.01 billion by 2030, with a compound annual growth rate (CAGR) of 24.7% from 2025 to 2030.

The Rise of Sodium-Ion Batteries:

The past two years have seen sodium-ion technology develop from a laboratory curiosity to a commercially available producer. The large battery manufacturers in China, including CATL and HiNa Battery, have unveiled commercial sodium-ion battery packs that are expected to be cheaper to produce, much quicker to charge, and more secure than lithium-ion counterparts. Currently, sodium-ion batteries are not as energy dense stoichiometrically as lithium, yet they have valuable attributes – their abundance and low cost, and that they do not rely on critical materials like cobalt or nickel – all of which are significant benefits particularly for stationary storage, micro-EVs, and two- and three-wheelers.

Why India Should Pay Attention

India is currently almost completely relying on imported lithium to meet its EV battery demands. This makes it significantly vulnerable to supply chain shocks, including Chinese export restrictions or geopolitical dislocations. Sodium, on the other hand, is widely available in-country, and India has a robust chemical manufacturing sector that could support sodium-ion battery production. Finally, the cost benefits of sodium-ion batteries may help stimulate further EV penetration in less price-insensitive market segments like two-wheelers and e-rickshaws, which dominate India’s urban and semi-urban transport ecosystem.

The Environmental Edge

Sodium-ion batteries not only provide cost savings but are also more sustainable. They eliminate the need for rare earth elements such as cobalt and nickel and can avoid some of the environmental damage caused by mining, and they are anticipated to be recyclable. Sodium can also be sourced from seawater, an initiative being explored in Japan and other research-oriented economies, which allows for long-term access to an abundant and non-toxic resource.

Who’s Leading the Charge?

China is clearly at the forefront, already rolling out sodium-powered electric scooters and planning integration into grid storage systems. In India, the movement is quieter but building. Reliance Industries’ acquisition of UK-based sodium-ion battery company Faradion in 2021 was a strategic signal of future intent. Some public research institutions like CSIR and IITs are also beginning to explore sodium-ion applications. However, India still lacks a robust ecosystem of startups, pilot projects, or dedicated policy focus in this domain.

Applications for India: EVs, Grid, and Beyond:

The most immediate use case for these batteries in India would be low-speed EVs and micro-mobility options like e-rickshaws, which don’t require high energy density. Another promising application is in stationary storage—microgrids, solar backup, and rural electrification projects where affordability and safety trump compactness. As India continues to invest in renewable energy, sodium-ion could become a key enabler of decentralized and reliable energy storage.

Challenges Ahead:

Despite the potential, sodium-ion batteries face multiple hurdles. Their lower energy density limits application in long-range EVs. The technology is still in its early age and needs time for maturing, and commercial-scale manufacturing is limited. India lacks the pilot projects and policy incentives that could accelerate adoption. Without targeted R&D funding and industrial partnerships, the technology may remain a missed opportunity.

Sodium-ion may not dethrone lithium overnight, but they offer India a compelling alternative for certain segments of the energy and mobility market. With strategic investment, policy support, and industry collaboration, it could help India reduce its import dependence and build a more localized, resilient battery supply chain. As the world looks beyond lithium, perhaps it’s time for India to take the lead in this ‘salt-powered’ revolution.