What if the future of electric vehicles wasn’t defined by luxury, speed, or range—but by affordability? For years, the biggest roadblock to mass EV adoption has not been technology itself, but cost. While governments champion electrification and automakers invest billions in R&D, the reality remains that most EVs are priced out of reach for everyday consumers in India and many other markets. That could be changing. A new generation of battery technologies, particularly semi-solid state batteries, is starting to make EVs more accessible than ever before. Industry analysts see this as a tipping point—where innovations in chemistry are finally intersecting with economic feasibility.

Take the MG4, for example. Recently launched at a price point between $10,000 and $14,000, it is among the first mass-produced EVs to leverage semi-solid state battery technology. While this model has captured headlines, its true significance lies in what it represents: a shift toward breaking the affordability barrier that has long limited EV adoption.

The larger story isn’t about a single car—it’s about the changing economics of energy storage. Semi-solid batteries balance energy density, safety, and lifecycle performance, while offering cost advantages over conventional lithium-ion. This positions them as a “bridge technology” that could redefine the EV market globally, especially in price-sensitive regions like India.

Understanding Semi-Solid State Batteries

To understand the buzz, let’s decode the science. Semi-solid state batteries sit between traditional liquid lithium-ion and next-gen solid-state batteries. Instead of relying on volatile liquid electrolytes, they use a gel-like electrolyte, which blends the safety and stability of solid-state with the conductivity and manufacturing familiarity of liquid systems.

Key technical advantages:

Higher energy density: Semi-solid cells can reach ~180 Wh/kg, enabling longer driving ranges without significantly increasing weight.

- Safety boost: Reduced risk of dendrite formation and thermal runaway, making EVs safer in diverse climates.

- Cost efficiency: Unlike solid-state, which requires entirely new manufacturing lines, semi-solid can be produced on modified lithium-ion production setups, reducing transition costs for automakers.

Think of it as a “halfway house”—leveraging today’s scalable infrastructure while preparing the industry for the leap into full solid-state. No wonder global giants like CATL, MG, NIO, and Toyota are investing heavily here.

For readers, imagine your phone’s lithium battery but with an “upgrade patch” that makes it safer, lighter, and cheaper to build—without waiting another decade for futuristic labs to scale. That’s the essence of semi-solid state batteries.

The Semi-Solid Revolution

July 2024 saw SAIC’s MG4 electric hatchback become the first commercially available, well-built EV with semi-solid batteries sourced from CATL. The MG4 had an energy density of 180 Wh/kg and a range of greater than 330 miles which made it the least expensive EV utilizing semi-solid battery technology.

The consequences of the MG4 are significant. For decades, industry experts have waited for the semi-solid technology to be slowly adopted into mass production. Now it is off the assembly line and onto the streets and highways worldwide.

The MG4 also plays into a larger Chinese strategy to control low-cost EVs. Tesla, BMW, and Mercedes are all targeting the premium/ high-end EV market while Chinese manufacturers focusing on sub-$15,000 market and that it is the low cost that will fuel global expansion.

Other players are also accelerating:

- NIO introduced semi-solid batteries in higher-end sedans for extended ranges.

- BYD is exploring hybrid approaches to improve safety and performance.

- Toyota is advancing both solid and semi-solid prototypes, aiming for early-2030s mass rollout.

Global EV adoption mirrors this trend:

- China: 30%+ penetration.

- Europe: ~20%.

- US: ~10%.

The message is clear: affordability paired with advanced chemistry could be the combination that pushes EVs from niche to mainstream.

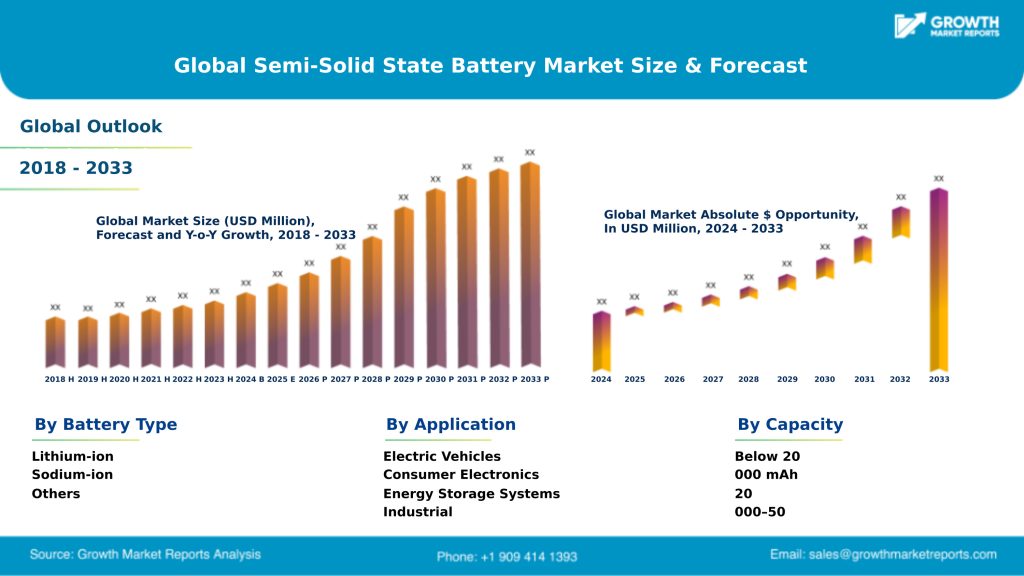

Market Snapshot: Semi-Solid Battery Market Outlook

The semi-solid state battery segment is experiencing robust growth and evolving into a dynamic investment arena:

Metric Value

- Market Size (2024) ~$1.34 billion

- Projected Market (2033) ~$13.03 billion

- CAGR (2025–2033) Approx. 27.6%

Alternative estimates — focusing specifically on electrolyte additives within semi-solid batteries — place the 2024 market at around $1.2 billion, growing to $3.5 billion by 2033 (CAGR ~15.5%).

Regional Landscape

- Asia-Pacific accounts for approximately 40% of the global semi-solid battery market, supported by strong battery manufacturing ecosystems in China, Japan, South Korea, and India.

- North America follows with roughly 30%, and Europe captures around 20%.

EV-Specific Outlook

- The semi-solid battery market specific to electric vehicles alone is approximately $1.5 billion in 2024 and is projected to grow to $8 billion by 2033 implying a CAGR of ~23%.

The $10K Barrier: Why Price is the Market Disruptor

For decades, the automotive industry has known the real disruptor is not faster charging or even doubling the range, it is price parity with petrol cars.

Currently, internal combustion engine (ICE) vehicles are dominating simply because they are cheaper upfront also with higher lifetime fuel costs. EVs however, have expensive lithium-ion batteries (~$130/kWh in 2023) that make short term price comparisons impossible.

Semi-solid batteries address this head-on:

- Cost downshift: They reduce material use and simplify packaging.

- Scalability advantage: Reuse of existing lines lowers capital expenditure for automakers.

- Target threshold: BloombergNEF identifies $100/kWh as the critical point where EVs achieve price parity with ICE. Semi-solid may accelerate this milestone.

For a middle-class family deciding between a petrol hatchback and an EV, the MG4 at ~$10K is a game-changer. The psychological and economic “barrier” isn’t just technical; it’s what unlocks mainstream consumer trust.

Indian Context: Semi-Solid Batteries in the Subcontinent

India, one of the fastest-growing auto markets, is also one of the most price-sensitive. Over 75% of cars sold are priced under ₹10 lakh (~$12K). This is why India’s EV adoption, while growing, has lagged China and Europe.

Semi-solid batteries offer India a golden opportunity:

- Affordability edge: An MG4-like EV priced near ₹10–12 lakh could shift perception from “premium” to “practical.”

- Two- and three-wheelers: These segments make up the bulk of India’s EV sales. Semi-solid can extend ranges while keeping costs competitive for Ola Electric, Ather, or Piaggio.

- Local R & D: Startups like Log9 Materials and Ola Electric are researching alternative chemistries (aluminum-air, lithium alternatives). It is possible that semi-solid tech could support these developments.

- Policy push: Government policy in India with the PLI program for ACC batteries and the subsidies from FAME II have created the conditions for local production.

- Urban deployment: The pollution challenges of India’s cities highlight the need for affordable EV adoption. Semi-solid has the safety and efficiency that can address hot-climate and congested grid concerns.

Picture it – Delhi’s e-rickshaws, delivery fleets, and even a reliable family hatchback, all using semi-solid packs – could this be India’s EV tipping point?

Obstacles and Barriers

Back to reality, semi-solid batteries still have an uphill battle:

- Manufacturing scalability: Converting existing lines is cheaper than solid-state, but it nonetheless requires investment to scale up.

- Supply chain: Lithium, cobalt, and nickel have volatility, and we are in a dead-end currently relying on both lithium and nickel, and both are fickle in price and availability. Sodium is not yet alternative.

- Performance under heat: Indian summers consistently reach 45° C. Gel electrolytes need to prove they will not fail in such conditions.

- Recycling: Different chemistries will need equally developed recycling and circular economy systems.

If we do not address these roadblocks, semi-solid battery technologies could be limited to niche applications instead of mass disruption.

Future Outlook: Semi-Solid vs Solid vs Sodium

Industry experts see semi-solid as the transition fuel for EV adoption. While solid-state promises 400+ Wh/kg and ultimate safety, its scalability is at least a decade away.

Semi-solid’s timeline:

- MG4 shows readiness today.

- SVOLT and CATL forecast broader rollouts by 2026–27.

- By 2030, semi-solid could dominate affordable EV categories globally.

Meanwhile, sodium-ion batteries are gaining momentum, particularly in India, thanks to abundant raw materials and low cost. For shorter-range two-wheelers, sodium could be as disruptive as semi-solid is for cars.

The future will likely be pluralistic: lithium semi-solid for cars, sodium for scooters, and eventually solid-state for premium EVs.

Conclusion

The affordability breakthrough that semi-solid batteries promise could be the inflection point for mass EV adoption. The technology blends safety, efficiency, and cost reduction—qualities that may finally put EVs within reach of the average consumer.

What we’re witnessing isn’t just the arrival of another car or battery innovation. It’s the beginning of a new chapter in electric mobility, where affordability becomes the true disruptor.