Batteries are at the heart of technological progress as the world is transitioning to electric mobility and energy storage. The first one to support this revolution is lithium-ion batteries, but as change is the only constant, the industry wants something more powerful and safer to use, and here come solid-state batteries (SSBs). The one touted as the “holy grail” of energy storage offers more safety, longer life cycles, and faster charging as well as longer range. But the question is, who will be the leader of this revolution?

The high-stakes race is going on among automakers like Toyota and start-ups like QuantumScape to develop scalable solid-state solutions. The world can see a wave of transition in the global energy storage hierarchy in the next few years as governments are introducing supportive regulations and funding initiatives and India is focusing more on innovations in the battery industry.

Let’s now understand the concept of solid-state batteries.

The solid-state battery marks a substantial advancement over the existing lithium-ion technology. In the traditional lithium-ion cell, a liquid electrolyte allows ions to move between the anode and the cathode. This liquid is temperature-sensitive and also flammable in nature, resulting in limiting the safety and energy density. In comparison, when we talk about the solid-state batteries, it replaces the liquid electrolyte with a solid ceramic or polymer material, allowing:

- Faster Charging

- Fire or leakage safety

- More thermal stability

- Longer lifespan and

- Higher energy density

This revolution invites us to electric vehicles (EVs) with over 1,000 km range, smartphones that are usable for days, and energy storage products that degrade very little over time.

The Global Solid-State Dominance Race

1. Japan

Headlining the pack is Toyota, which has already submitted more than 1,000 patents for solid-state battery technology. It aims to put its first SSB-powered hybrid on the market by 2027. Toyota asserts these batteries will be charged from 0 to 100% in 10 minutes.

2. United States

US-based startup QuantumScape, backed by Volkswagen and Bill Gates, is working on lithium-metal solid-state batteries. The firm has shown 80% capacity retention at 800+ cycles and plans pilot production by 2025.

3. South Korea

Samsung SDI and LG Energy Solution are driving pilot production lines for SSBs with an emphasis on sulfide-based solid electrolytes. Samsung’s prototype is said to reach 900 Wh/L, almost twice of the existing Li-ion densities.

4. China

CATL, the globe’s biggest battery manufacturer, is planning near-term plans for semi-solid-state batteries and investing in full SSB R&D for the long term.

5. Europe

Europe is financing multiple projects under the Battery 2030+ and Horizon Europe programs with the aim to cut dependence on Chinese supply chains by leading in next-generation technologies.

India’s Place in the Solid-State Space

India, as a late entrant in the lithium-ion game, has a golden chance to jumpstart into the SSB age. The developments are:

PLI Scheme for Advanced Chemistry Cells (ACC): With a budget of ₹18,100 crore, this scheme encourages Indian and overseas companies to establish giga-scale battery production.

NITI Aayog & DST Initiatives: There is growing emphasis on fostering advanced battery chemistries other than lithium-ion.

Private Players:

- Amara Raja has set up an innovation center working on solid-state prototypes.

- Exide Industries, in partnership with Leclanché, is also investigating next-generation storage options.

- Ola Electric has recently established a battery innovation center and has indicated working on in-house SSB development.

- Startups such as Log 9 Materials and Gegadyne Energy are also working on fast-charging battery options, including semi-solid-state chemistries.

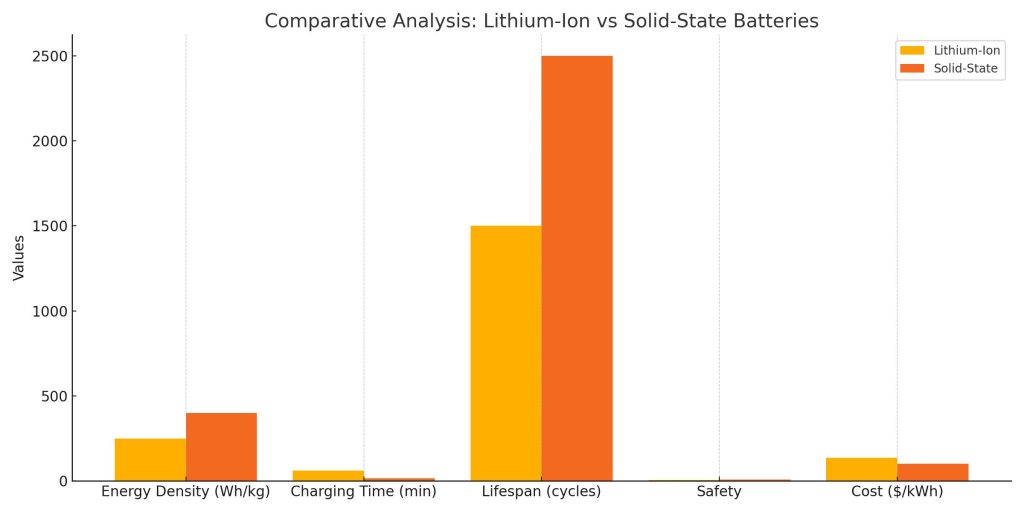

Lithium-ion vs. Solid-State Battery Comparison

Here’s a graphical comparison of key performance metrics between lithium-ion and solid-state batteries:

| Metric | Lithium-ion | Solid-State |

| Energy Density | 250 Wh/kg | 400 Wh/kg |

| Charging Time | ~60 minutes | ~15 minutes |

| Cycle Life | ~1,000 cycles | ~2,000 cycles |

| Thermal Stability | ~150°C | ~300°C |

Solid-State Battery Commercialization Challenges

In spite of their promise, solid-state batteries have significant hurdles:

- High Cost of Manufacture: Solid electrolytes are costly and need proprietary manufacturing facilities.

- Formation of Dendrites: Lithium dendrites are still a possibility, particularly in lithium-metal anodes, leading to short circuits.

- Scale-Up Difficulty: Scalability from lab-scale prototypes to GWh mass production continues to be a challenge.

- Material Issues: Certain solid electrolytes are brittle or chemically unstable at high voltage.

Regulatory Push: India and the World

India

- Battery Waste Management Rules (2022) and Amended Rules of 2025: Designed to ensure safe recycling and disposal of battery material, including future chemistries. and the amendment act emphasizes EPR focus

- FAME-II and Future FAME-III: Encourages adoption of EV but can have provisions for safer battery chemistries.

- BIS Standards for Batteries: Expected to be revised for solid-state and other new-age chemistries in the next few years.

Europe

- Battery Passport (In force 2026–2030): Mandates traceability, carbon footprint declaration, and responsible sourcing for all batteries placed on the EU market.

- Green Deal Policies: Support the development of environmentally friendly battery manufacturing and local supply chains.

United States

- Inflation Reduction Act (IRA): Grants substantial tax incentives for US-made batteries and raw materials, including for solid-state technologies.

- DOE Advanced Battery Consortium: Supporting pilot projects and university-industry cooperation on SSBs.

Market Projections

- The solid-state battery market can potentially be valued at $25 billion in 2030, according to BloombergNEF.

- India’s own share may increase to 5–7% if government and private sector players collaborate on R&D and local manufacturing.

- SSBs can expect to hold 10% of the world EV battery market by 2030, increasing to 40% by 2040.

What India Must Do

If India is to capture this window of opportunity, the following are essential steps:

- Directed R&D Investments: Establish government-sponsored SSB laboratories, similar to the Fraunhofer system in Germany.

- Skilling Programs: Develop specialized courses in solid-state chemistry and battery design.

- Raw Material Security: Obtain secure supply chains for lithium, sulfides, and garnets by way of trade or prospecting.

- Support Startups: Provide grants, incubation, and pilot production floors to entrepreneurs.

- Bilateral Collaborations: Collaborate with Japan, Germany, and the US on collaborative R&D.

Conclusion

Solid-state batteries are a technological leap beyond—yet a strategic necessity in an age of clean energy and electric mobility. While the world is in a ferocious competition to lead this next generation, India will need to break free from legacy chemistries and invest in creating a future-proofed battery ecosystem. The time to act is now, before global supply chains fasten around winners. Whether India evolves to become a leader or just a follower in the world of battery technology will be determined by how aggressively and quickly it adopts this shift.