Wärtsilä has released its half-year financial report january–june 2025

ORDER INTAKE, NET SALES, OPERATING RESULT AND CASH FLOW ALL INCREASED

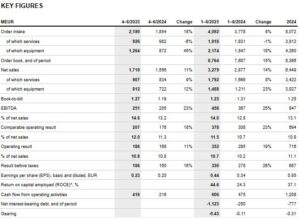

Highlights from April–June 2025

- Order intake increased by 18% to EUR 2,190 million (1,854), while the organic growth, which excludes FX impact and the impact of acquisitions and divestments, was 20%

- Service order intake decreased by 6% to EUR 926 million (982)

- Net sales increased by 11% to EUR 1,719 million (1,556), while organic growth was 13%

- Book-to-bill amounted to 1.27 (1.19)

- The comparable operating result increased by 18% to EUR 207 million (176), which represents 12.0% of net sales (11.3)

- The operating result increased by 11% to EUR 186 million (168), which represents 10.8% of net sales (10.8)

- Earnings per share increased to 0.23 euro (0.20)

- Cash flow from operating activities increased to EUR 416 million (216)

Highlights from January–June 2025

- Order intake increased by 8% to EUR 4,092 million (3,778).

- Service order intake remained stable at EUR 1,918 million (1,931)

- The order book at the end of the period increased by 15% to EUR 8,764 million (7,607)

- Net sales increased by 14% to EUR 3,279 million (2,877)

- Book-to-bill amounted to 1.25 (1.31)

- The comparable operating result increased by 23% to EUR 378 million (308), which represents 11.5% of net sales (10.7)

- The operating result increased by 19% to EUR 352 million (295), which represents 10.7% of net sales (10.2)

- Earnings per share increased to 0.44 euro (0.34)

- Cash flow from operating activities was on a good level at EUR 606 million (475)

WÄRTSILÄ’S PROSPECTS

Marine

Wärtsilä expects the demand environment for the next 12 months (Q3/2025-Q2/2026) to be better than in the comparison period.

Energy

Wärtsilä expects the demand environment for the next 12 months (Q3/2025-Q2/2026) to be similar to that of the comparison period.

Energy Storage

Wärtsilä expects the demand environment for the next 12 months (Q3/2025–Q2/2026) to be better than in the comparison period. However, the current geopolitical uncertainty particularly impacts this business and may affect growth.

In general, Wärtsilä underlines that the current high external uncertainties make forward-looking statements challenging. Due to high geopolitical uncertainty, the changing landscape of global trade, and the lack of clarity related to tariffs, there are risks of postponements in investment decisions and of global economic activity slowing down.

“The second quarter of 2025 was strong for Wärtsilä, with increases in order intake, net sales, operating result and cash flow. We ended the quarter with an all-time-high order book of EUR 8,764 million.

However, the global economic outlook remained uncertain due to increased trade barriers and policy uncertainty. This, combined with the risk of further protectionism, could add to inflationary pressures and dampen growth in global economic activity.

In the energy market, the rising global electricity demand is driving the need for new power generation capacity. The ongoing global energy transition is expected to continue, with renewables meeting most of the upcoming capacity growth, as these are the most affordable way to generate electricity. This trend will continue to support the demand for Wärtsilä’s balancing power offering, which includes both engine power plants and battery energy storage systems. However, the US market for battery energy storage is currently facing challenges due to increased tariffs, leading to heightened competition in other markets.

Baseload generation remains a consistent source of demand for engine power plants, particularly in remote areas and locations where grid power access is uncertain or time sensitive. For example, in the second quarter, we secured a large EPC order to supply 12 Wärtsilä 50 engines and auxiliaries for the Reko Diq copper-gold mining project in Pakistan. The solution will provide a critically needed reliable and economical power supply, enabling mining operations to function efficiently.

Our medium-speed engines also provide an excellent baseload solution for data centers, a rapidly expanding market with unique power requirements. I am very pleased to highlight the fact that we secured our first data center order from the US during the second quarter. We will supply a total of 15 Wärtsilä 50 engines, ensuring high availability of power. The data center segment continues to offer interesting business potential for Wärtsilä in both equipment and services.

In the marine market, the uncertain global economic outlook has dampened demand for new ship capacity in 2025. Slowing demand for tonnage, coupled with uncertainties in global trade policies and a strong supply of new ships, has led to mixed market conditions across many vessel segments. However, activity in Wärtsilä’s key segments, such as cruise and ferry, remains supportive.

In April, the 83rd session of the Marine Environment Protection Committee of the International Maritime Organization proposed a set of measures to drive the decarbonization of global shipping. Although these measures are still awaiting adoption in October 2025, they underscore the regulatory push to reduce emissions and encourage shipowners to continue their investments in decarbonization. During the first half of 2025, 183 orders for new alternative fuel-capable vessels were reported, accounting for 55% of the capacity of contracted vessels.

Wärtsilä continues to play an important role in the maritime industry’s decarbonization efforts, exemplified by the launch of our carbon capture solution during the second quarter. This innovative technology supports the ongoing efforts to significantly reduce vessel emissions and avoid stranded assets.

During the quarter we also announced that we will expand our state-of-the-art Sustainable Technology Hub in Vaasa, Finland, with a €50 million total investment. Expanding the R&D testing and manufacturing capacity will enhance Wärtsilä’s ability to meet the growing demand for developing and delivering sustainable technologies in marine and energy.

Order intake in the second quarter increased organically by 20%. Equipment order intake increased as a result of strong equipment orders in Energy and Marine. Service order intake decreased mainly due to lower project-oriented activities in retrofits and upgrades. All other service disciplines continue to grow, with rolling 12-month book-to-bill ratios above 1. Net sales increased organically by 13%, with increases in both equipment and service net sales.

The comparable operating result increased by 18% to EUR 207 million, representing 12.0% of net sales. The result was supported by increases in Energy, Marine and Portfolio Business. Cash flow from operating activities almost doubled, following the improved result and a good level of received customer payments. The current negative working capital level is very favorable for our business, and we expect it to normalize going forward. We will continue our active efforts to manage working capital to maintain it clearly below the long-term historical average.

We expect the demand environment for the coming 12 months to be better than in the comparison period in Marine and Energy Storage, while the demand environment in Energy is expected to remain at a similar level. It is worth noting that order intake in Energy has been very strong over the past 12 months. However, as we have outlined, the current high external uncertainties make forward-looking statements challenging.

We are making continued progress towards our financial targets, driven by our focus on supporting our customers towards a marine and energy future that is both environmentally sustainable and financially viable. Our strong financial position, industry-leading offering and mindset of continuous improvement equip us to navigate future challenges and capture the many opportunities offered by the decarbonization transformation.”

Wärtsilä presents certain alternative performance measures in accordance with the guidance issued by the European Securities and Markets Authority (ESMA). The definitions of these alternative performance measures are presented in the Calculations of financial ratios section.

ANALYST AND PRESS CONFERENCE

A virtual analyst and press conference will be held as a webinar on the same day, Friday, 18 July 2025, at 10.00 a.m. Finnish time (8.00 a.m. UK time).