As India accelerates toward its Net-Zero by 2070 goal, the spotlight has turned to a critical enabler of this mission: battery technology. Whether it’s electrifying vehicles, stabilizing renewable-heavy grids, or decarbonizing industrial energy use, batteries are central to India’s energy transition story.

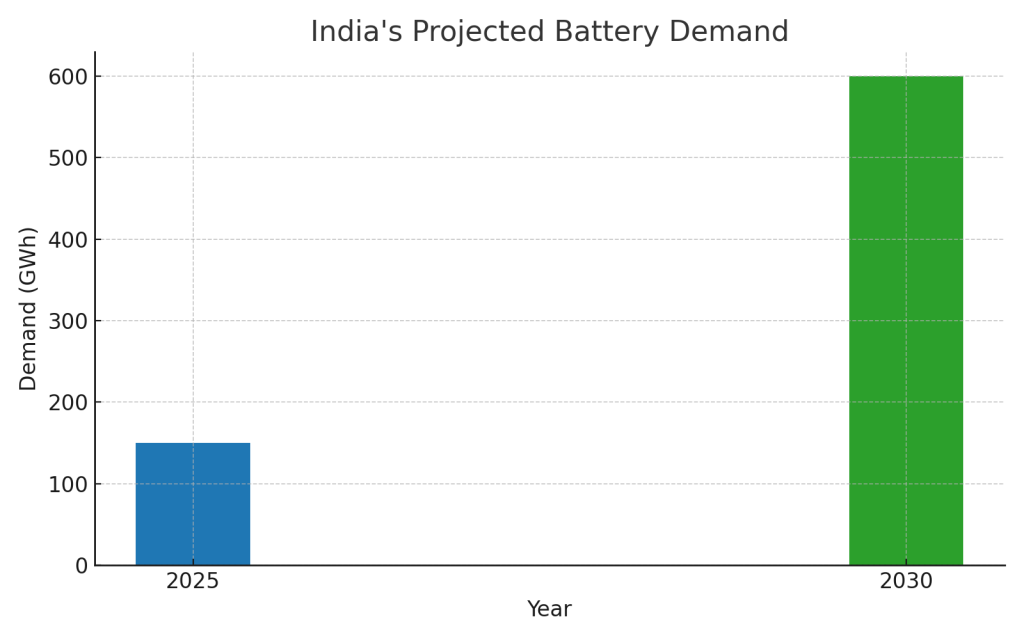

With rising EV adoption, a solar-dominant energy mix, and strategic policy support, India’s battery market is poised to witness an explosive surge in demand. According to NITI Aayog, India is projected to require over 600 GWh of battery storage by 2030—up from just 20 GWh in 2021. This exponential growth is pushing Indian battery companies to invest, innovate, and scale faster than ever before.

Why Batteries Will Be Central to India’s Green Future

Batteries are the critical technology in three major areas:

- Electric Vehicles (EVs): Batteries are essential for the government to achieve its target of 30% EV sales by 2030.

- Grid-Scale Storage: Batteries are the backbone of backup power to enable 24/7 access to renewable energy by storing surplus solar and wind energy.

- Industrial Decarbonization: Batteries are essential for backup power, automation in manufacturing, and new hydrogen ecosystems.

By the end of this decade, India will require 50+ gigafactories to meet its decarbonization goals.

Top 5 Battery Companies Driving the Net-Zero Mission

Several Indian battery manufacturers are now taking giant leaps—not only catching up to global counterparts but also setting unique benchmarks in localization, innovation, and scale.

1. Exide Energy Solutions Ltd.

Headquarters: Kolkata | Focus: LFP Cell Manufacturing

A name long associated with lead-acid batteries, Exide Industries has now pivoted toward lithium-ion technology with the launch of Exide Energy Solutions.

- Building a 6 GWh lithium-ion cell plant in Bengaluru.

- Focus on LFP (Lithium Iron Phosphate) chemistry—safer and cheaper for India’s climate.

- Collaboration with Leclanché SA (Switzerland) for tech know-how.

- Sustainability Angle: Transitioning legacy battery infrastructure into green manufacturing facilities with ESG benchmarks.

2. Amara Raja Energy and Mobility Ltd.

Headquarters: Tirupati | Type: Li-ion Gigafactory & Energy Storage Systems

- As a historical competitor of Exide, Amara Raja is now all-in on energy storage for the new age.

- Announced a 16 GWh Li-ion cell operation in Telangana as part of the PLI scheme.

- There is ongoing R&D related to solid-state batteries and green hydrogen storage.

- They are also offering energy-as-a-service for EV fleets and telecoms.

3. Tata Group – Tata AutoComp + Agratas Energy Storage Solutions

Headquarters: Pune & UK | Type: Battery Packs, BMS, and Gigafactories

- The Tata ecosystem is leveraging its strengths in automotive, avenues for software, and materials.

- Tata AutoComp is a leading supplier for EV battery packs and thermal management.

- For Agratas, which is part of Tata Sons, is building a 20 GWh gigafactory (first phase in the UK and India after).

- There is a strong link to Tata Motors with respect to the push towards EVs (Nexon EV, Punch EV).

- Net-Zero Link: Tata is leveraging its strengths in vertical integration to manage lifecycle emissions throughout its entire value chain.

4. HBL Power Systems Ltd.

Head Office: Hyderabad | Key Sectors: Defense, Railways, and Industrial Batteries

HBL Power Systems is less visible but has a firm foothold in India’s infrastructure, producing powerful batteries for high consequence applications.

- HBL Power Systems supplies Ni-Cd, VRLA, but now is also claiming lithium battery packs.

- They supply ISRO, the railways, DRDO, and have an excellent relationship with Air force commands where batteries are heavily used.

- They are innovating away from traditional battery chemistries into hybrid chemistries with extra long duration backup.

- Sustainability Note: Invests heavily in R&D in regard to recyclability and reuse of the industrial batteries.

5. GODI Energy Pvt. Ltd.

Headquarters: Hyderabad | Focus: Cell R&D, Advanced Chemistries

- A true deep-tech startup, GODI Energy is among India’s first homegrown Li-ion cell innovators.

- First Indian company to get BIS certification for cylindrical Li-ion cells.

- Working on silicon anodes, solid-state batteries, and 3.0 Ah cells.

- Has R&D MoUs with CSIR and IITs for material science breakthroughs.

- Why It Matters: GODI is India’s best bet for competing with global battery tech firms like Panasonic and CATL.

How These Companies Are Fueling Sustainability

India’s top battery firms are not just scaling—they are redefining green manufacturing:

Companies Newsroom List

| Company | Key Sustainability Action |

| Exide Energy | Solar-powered gigafactory, closed-loop recycling |

| Amara Raja | Green hydrogen pilot, energy-efficient plants |

| Tata Group | End-to-end EV ecosystem, carbon-neutral supply chain |

| HBL Power | Reusable rail batteries, defense-grade long-life systems |

| GODI Energy | Low-cobalt & solid-state research, indigenous material use |

These efforts ensure that scaling battery production won’t come at the cost of environmental degradation.

Challenges on the Road to 2030

While optimism runs high, key challenges remain:

- Raw Material Dependence: India imports over 70% of lithium, mainly from China and Australia.

- Technology Transfer: Matching the innovation curve of global firms requires massive R&D funding.

- Policy Uncertainty: Despite PLI and FAME, regulatory clarity on EV incentives and recycling is still evolving.

- Infrastructure: Logistics, power, and water needs for gigafactories can delay scale-up.

India’s Battery Future Is Bright—and Critical

As the world moves from fossil fuels to electrons, India’s ability to lead in battery tech will determine the success of its net-zero mission. The top 5 companies spotlighted here are not only producing batteries—they are building the backbone of a clean energy future.

From startup labs to gigafactories, India is gearing up to be a global hub for battery manufacturing, innovation, and sustainability.

Watch this space—because the race to net-zero is powered by what’s inside the cell.