The world is racing for battery gigafactory supremacy, and India, the fourth-largest automobile market globally, stands at a critical juncture. To build a robust domestic battery manufacturing ecosystem is not merely an ambition but a strategic necessity for economic growth. While Europe embarked on its own gigafactory journey with significant enthusiasm, its journey has faced many challenges along the way. By assimilating lessons from Europe’s battery gigafactory experiences, India can strategically position itself as a global leader in battery manufacturing.

Europe’s Battery Experience: A Cautionary Tale

Europe’s commitment to battery dominance is led by programs like the European Battery Alliance, which aims to establish a competitive and sustainable battery ecosystem. However, obstacles have emerged, like financial strains, overcapacity, and underutilization. For example, Sweden’s Northvolt faced significant financial hurdles during its early stages, resulting in operational setbacks. Furthermore, the UK’s recent £1 billion investment in AESC’s Sunderland gigafactory highlights the high capital needs and the importance of aligning production with real demand.

Several factors have contributed to these setbacks in Europe:

- Slowing EV Market Growth: The anticipated forecasts for the European EV market experienced a downturn in mid-2024, creating uncertainty for battery manufacturers there.

- Technological Shifts: The rapid pace of battery technology evolution necessitates continuous adaptation and investment, posing challenges for long-term project viability. McKinsey & Company highlighted that gigafactories can take 3-6 years to reach full capacity, risking obsolescence if they opt for “dated” cell chemistries.

- High Costs and Labor Issues: Europe faces challenges related to high energy and labor costs compared to other regions. Moreover, a shortage of skilled labor in battery manufacturing is a growing concern. The EU is planning a European Battery Academy to address an estimated shortage of 800,000 skilled workers by 2025.

- Competition and Incentives from Other Regions: Generous incentives offered by countries like the United States through the Inflation Reduction Act have influenced some European battery companies, prompting considerations of relocation and impacting Europe’s envisioned domestic capacity.

- Supply Chain Dependencies: Europe remains heavily reliant on external sources or third countries for critical raw materials, leaving vulnerabilities in its battery supply chain.

India’s Strategic Roadmap: A vision to become a Battery Leader

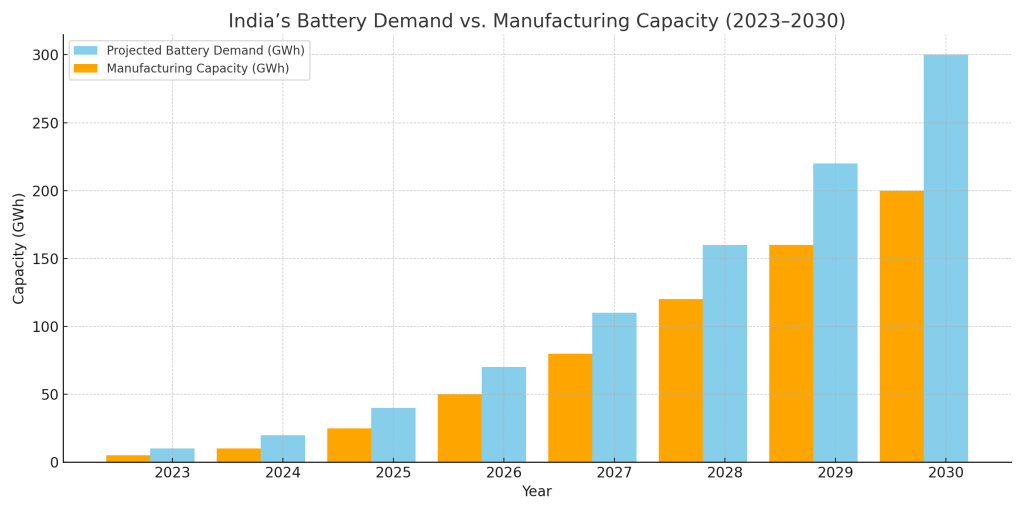

Despite the challenges encountered by Europe, the long-term trajectory for battery demand remains exceptionally strong, fueled by the growing adoption of electric vehicles and the need for grid-scale energy storage solutions. India’s ‘Battery Manufacturing Vision’ sets a target for an impressive 500 GWh of annual capacity by 2035, potentially attracting $35 billion in investments and creating over 2.6 million jobs. With current projections estimating 110–150 GWh capacity by 2027–28, India is poised to meet its burgeoning domestic demand, projected to reach 250 GWh annually by 2030. Rho Motion forecasts India’s battery demand to increase almost tenfold by 2030, with significant growth expected in the electric two-wheeler, three-wheeler, and passenger car segments, reaching over 30 GWh each. Demand from mobile phones will also contribute substantially.

Several prominent Indian companies are actively pursuing gigafactory development projects. The Tata group’s Agratas Energy Storage Solutions is setting up a 20 GWh lithium-ion battery cell factory in Gujarat, while Amara Raja Energy & Mobility aims for 16 GWh capacity by 2030. Ola Electric also has plans for a 20 GWh facility. ICRA projects India to have over 150 GWh of lithium-ion battery cell capacity by 2030, attracting investments exceeding ₹75,000 crore.

Key Lessons from Europe’s Journey: India’s Strategic Advances

India has a unique opportunity to learn from the experiences of Europe to forge a more resilient and ultimately a successful battery manufacturing ecosystem. The key lies in proactively addressing the pitfalls encountered by their European counterparts while leveraging India’s unique strengths:

- Demand-Driven Expansion: India can learn from Europe’s experience of overambitious capacity plans that now face underutilization due to slower-than-expected EV adoption. By adopting a more measured and demand-driven approach to gigafactory development, potentially exploring stationary energy storage applications and export markets to ensure optimal capacity utilization, India can ensure optimal capacity utilization and avoid underutilization risks highlighted by ICRA’s projections of potential oversupply by 2030.

- Focus on Domestic Supply Chain Development:

Europe’s reliance on external suppliers exposed vulnerabilities. India is now focusing on localizing key components, such as cathodes, synthetic anodes, cell casings, and electrolytes, which can enhance supply chain resilience as India has existing capabilities and lower technological dependence. Investing in domestic mining and processing of raw materials, even if reserves are currently limited, and promoting battery recycling to recover critical minerals are crucial long-term strategies. - Prioritizing LFP Chemistry: Unlike the European focus on NMC (Nickel-Manganese-Cobalt) batteries, Indian manufacturers are leaning towards LFP (Lithium-Ferrous-Phosphate) batteries. LFP offers lower costs to 50% cheaper than Chinese counterparts, longer lifecycles, and better performance in India’s hot and humid climate, owing to lower production costs and PLI incentives.

- Policy Support and Incentives:

Europe’s initiatives benefited from substantial governmental support. The Indian government is also actively promoting the Production Linked Incentive (PLI) scheme, with an outlay of ₹18,100 crore for Advanced Chemistry Cell (ACC) battery storage that aims to bolster domestic manufacturing and attract global players. - Skill Development Initiatives: Recognizing that a skilled workforce is the backbone of a thriving manufacturing sector, India can proactively invest in training programs and partnerships with global innovation hubs to develop specialized curricula focused on the battery supply chain, mitigating potential labor shortages.

- Emphasis on R&D and Innovation: To stay ahead in the rapidly evolving battery technology landscape, Continuous investment in research and development is crucial. Government support and incentives for private sector innovation, along with the establishment of centers of excellence in battery technology, can accelerate the development and commercialization of next-generation battery technologies.

- India’s Competitive Edge: Leveraging Strengths

- Diverse Market Demand:

Unlike Europe, where passenger EVs dominate, India’s battery demand spans two- and three-wheelers, commercial vehicles, and stationary storage, offering a broader market base. - Strategic Investments:

Major Indian Conglomerates like JSW Group and Tata Motors are investing heavily in battery manufacturing, with JSW aiming for 50 GWh capacity by 2030.

Conclusion: India’s path to be a Battery Dominant Country

By internalizing the lessons from Europe’s gigafactory journey and tailoring strategies to its unique context, India can not only meet its domestic energy storage needs but also emerge as a global hub for battery manufacturing. A focus on cost competitiveness, strategic technology choices like LFP, robust government support, domestic supply chain development, and a skilled workforce will be paramount. While the path may have its challenges, India’s potential in this crucial sector is immense, promising to power its clean energy future and position it as a significant global player in the battery market. The time for India to take its gigafactory leap, informed by global experiences, is now.