The electric vehicle (EV) revolution in India is no longer at a point to question if, but how fast and how sustainably. With the government’s push for sustainability and decarbonization and to reach 10 million annual EV sales by 2030 with a goal of 30% EV adoption, the infrastructure to lead this charge has become the subject of debate—fast charging versus battery swapping.

So, what do you think? Which technology will dominate the market? The answer to this debate is more than just technical—it’s about shaping the financial, operational, and logistical spine of India’s EV ecosystem. The choice could shape the future of electric mobility in India for the stakeholders—from policymakers to battery OEMs and fleet operators.

Now, let’s explore the benefits, challenges, latest data, and where the future is likely headed.

Fast Charging:

Fast charging stations (FCS) have emerged as the go-to EV recharging method globally. It uses high-voltage direct current (DC) to juice up a battery from 0 to 80% in just less than an hour.

Advantages:

- Ideal for private vehicles; works with existing gas station models.

- OEM Compatibility: Most EVs already support fast charging standards like CCS2 and CHAdeMO.

- Suitable for passenger cars and long-range EVs.

- Global Infrastructure Alignment: Aligns with international standards and strategies.

Challenges:

- Grid Load: High power demand strains the grid during peak hours.

- Land Cost & Space: Needs dedicated space at highways and urban locations(₹25–40 lakh per charging station).

- Battery Degradation: Frequent fast charging can reduce battery life.

- Not ideal for 2- and 3-wheelers or high-density urban zones.

B2B Insight: OEMs such as Tata Motors and Hyundai are investing in fast-charging corridors, while oil marketing companies like IOCL and BPCL are rapidly adding charging points at fuel stations.

Battery Swapping :

In this process a depleted battery is replaced with a fully charged one at a battery swapping station in just a few minutes.

Advantages

- Speed: Quicker than even the fastest charging tech.

- Reduces upfront vehicle cost through battery-as-a-service (BaaS) models.

- Fleet Friendly: Perfect for 2Ws, 3Ws, and logistics fleets with predictable routes.

- Grid Balancing: Charging happens off-peak in a controlled environment.

Challenges:

- Standardization: No universal battery format across OEMs.

- CapEx-Heavy: Involves spending on both infrastructure and battery inventory.

- Ownership & Liability: Questions regarding battery condition and accountability.

- Less practical for high-capacity, battery-powered, larger EVs.

B2B Insight: SUN Mobility, Gogoro, and Ola Electric are testing large-scale swappable networks with modular, interoperable batteries.

Fast Charging vs Battery Swapping—Quick Comparison

| Feature | Fast Charging | Battery Swapping |

| Time to Recharge | 30-60 mins | 2-5 mins |

| CapEx per Station | ₹25–40 lakh | ₹10–15 lakh

|

| Ideal For | Cars, Fleet EVs | 1. 2W, 3W, Delivery Vehicles

|

| Battery Ownership | User-owned | Battery-as-a-service (BaaS) |

| Grid Load Impact | High | Moderate |

| Standardization Needed | Moderate | High |

Government Policy and Market Signals

- In 2022, India’s Battery Swapping Policy draft proposed incentives for interoperability and BaaS business models. However, FAME II continues to prioritize fast charging through subsidies for charging stations.

- According to a NITI Aayog and Rocky Mountain Institute report, India could save up to ₹20 lakh crore in oil imports by 2030 if EV adoption is accelerated through efficient infrastructure.

Battery swapping for 2Ws and 3Ws could grow from ₹500 Cr in 2022 to ₹7,000 Cr by 2028, per NITI Aayog projections.

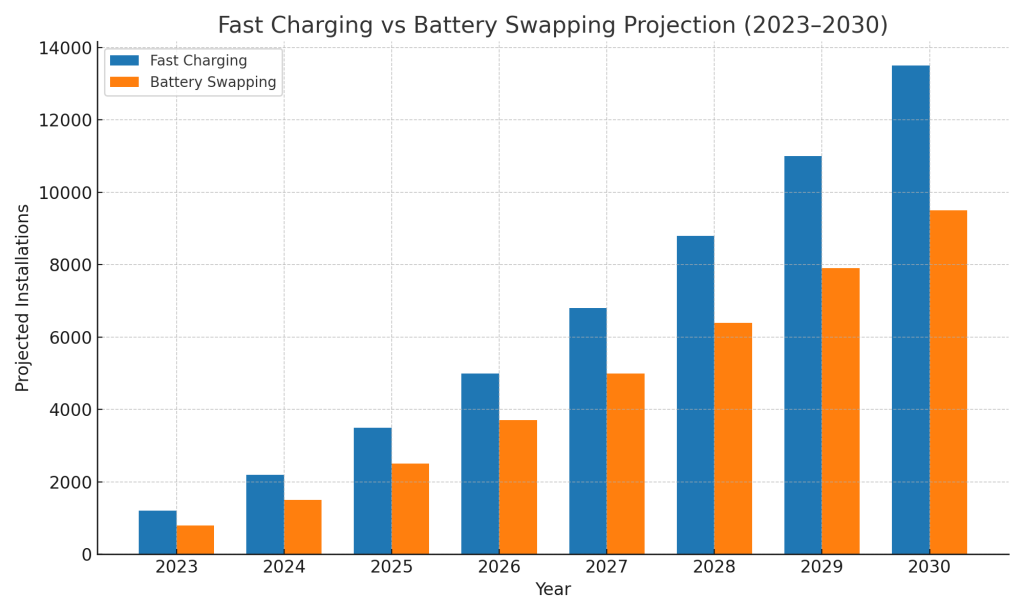

Industry Forecast: Dual Infrastructure Path Ahead

Recent forecasts suggest that both models will coexist, but with different dominant use cases.

Fast charging is expected to scale faster initially due to global alignment and private investments.

Battery swapping may dominate 2W and 3W commercial segments, especially in Tier-II and Tier-III cities.

Emerging Research & Market Trends

A 2024 McKinsey report on “EV Infrastructure in Asia” stated that urban swapping networks can reduce operational costs by 25% in last-mile logistics.

BloombergNEF forecasts that India will need at least 4 lakh charging stations and 1 lakh battery swap stations by 2030 to meet demand.

Global Comparisons: Lessons from Abroad

- China: EV giant NIO has rolled out more than 1,000 battery swap stations, supported by generous government subsidies. Swapping is booming, particularly for taxis and ride-hailing.

- Taiwan: Gogoro has a national network of battery-swapping for 2-wheelers.

- Europe: Public infrastructure is more geared towards rapid charging, thanks to the diversity of vehicles and robust grids.

Key Insight: Battery swapping works best with policy backing, standardization, and targeted use cases.

Case Study: Delhi’s EV Transition

The Delhi government’s EV policy has included battery-swapping kiosks in its incentives since 2021. E-rickshaws and food delivery fleets now rely heavily on this infrastructure.

The debate between fast charging and battery swapping isn’t about choosing a winner—it’s about defining the right tool for the right job. In a diverse and geographically vast country like India, both systems are likely to coexist.

For B2B players—from battery makers to bus operators—the ultimate opportunity is integration, interoperability, and smart deployment.